How To Make A Profit In A Downturn

In last month’s article, I said that good agents can make money during a downturn in the housing market. In view of the economic damage caused by Liz Truss’s disastrous mini-Budget, it seems appropriate this month to cover this topic in much greater detail.

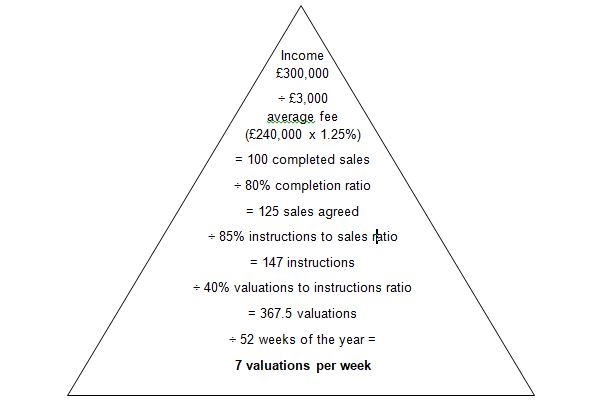

Let’s take as an example an estate agency which generates income of £600,000 per annum with a profit of £120,000 per annum. Let’s assume that it earns £300,000 from sales and £300,000 from lettings.

All the evidence suggests that the letting income will remain constant this year. A few landlords are selling their buy to let properties due to the increase in mortgage rates and the endless anti-landlord compliance legislation. However, as a consequence, those landlords that remain are seeing a sharp increase in their rents. A 10% increase in rents will mean a significant increase in fees for letting agents. It won’t be 10% because not all fees are quoted as a percentage of rent. However, it will still be at least 7.5%. This will add £22,500 to the letting income which should be more than enough to offset any landlords who sell their properties next year.The residential sales income will be far more volatile. Let’s assume that last year’s £300,000 of income was made up like this:

How could this change during a market downturn? Let’s make the following assumptions:

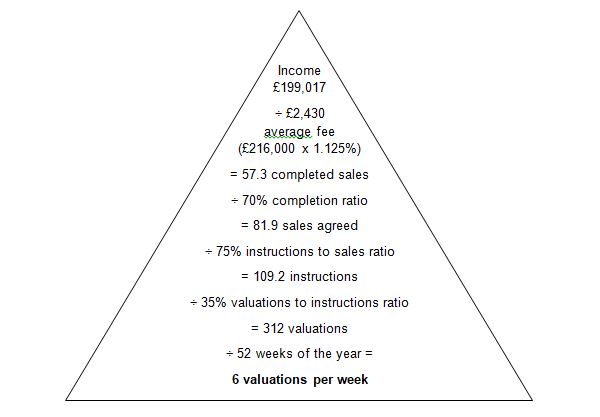

- The sale price falls by 10% to £216,000 due to higher mortgage rates

- The fee drops by 10% to 1.125% due to increased competition caused by less properties coming to the market

- This means that the average fee drops from £3,000 to £2,430, i.e. £216,000 x 1.125%

- Let’s agree that the completion ratio drops from 80% to 70% because buyers have difficulty getting mortgage finance

- Let’s assume that the instructions to sales ratio drops from 85% to 75% because buyers are nervous about buying a house in such an uncertain economic climate

- Let’s assume that the valuations to instructions ratio drops from 40% to 35% because agents are competing for a smaller number of properties

- Finally, let’s assume that the number of valuations drops from 7 per week to 6 per week because sellers delay their sales until market conditions improve.

What does this do to the sales income? Well, here is the calculation:

Because these changes are cumulative, the income drops by £100,000 nearly all of which will come straight off the profit leaving a profit of almost zero.

Fortunately, this is not inevitable and there are many things that good agents can do to impact each one of these key ratios.

Clever marketing, proper use of Google and social media and going back through old data can have a huge impact on the number of valuations.

The instructions to sales ratio can be increased by making a better sales pitch, ensuring that only the best valuers carry out instruction appointments and by following up old valuations more rigorously.

The instructions to sales ratio can be improved by using the telephone properly to follow up details and encourage viewings, by following up viewings more effectively – again, by telephone – and by working harder to obtain price reductions on properties that are not selling.

The completion ratio can be improved by making sure that every buyer and every seller instructs a high-quality specialist conveyancing solicitor and by spending more time progressing sales in a proactive way.

The average fee can be increased by explaining eloquently and persuasively how a better agent can achieve a better price and by offering performance-related fees linked to the price that is achieved.

Finally, if there is still a shortfall in revenue, it can be made up by earning more introductory fees from selling conveyancing and mortgage services.

As an absolute last resort, you may need to resort to cost cutting and if this is the case, there is no point tinkering around the edges. A business with a revenue of £600,000 per annum will be spending £250,000 to £300,000 per annum on staff salaries and in a vicious downturn, staff redundancies will probably be the only way to protect your profit margin.

The final and most important thing to remember is that no downturn lasts forever and you need to keep a very careful watch on your key ratios in order to ensure that as soon as there are signs of life in the market, you can get your foot back on the gas immediately in order to take full advantage of the improved market conditions.

There are many, many examples of agents who did all these things successfully during the 2009 downturn and the same techniques will work again no matter what the market does during next year.

Adam Walker is a management consultant and business transfer agent who has specialised in the property sector for more than forty years.